How Many Properties Do You need to Own to Make Real Estate Investing Lucrative?

The "how many properties one" is a good question I was asked the other day. I see this regularly and I believe the reply would be a great one to share with you all. The answer of course varies by the individual and their personal objective. In the spirit of being transparent I will tell you straight up that one property alone may be lucrative but will not set your retirement account a blazing. The easy answer...Most real estate investors start with 3 to 5 properties and usually go on to double or triple that.

Depending on your goals of what you want to accomplish and how soon you want to accomplish them, most people believe they want 3 to 5 properties in their investment portfolio. That said, once they get 3 to 5 properties, then the process has become easier and they have it in their blood to continue to build their portfolio.

Appreciation, growth per year, tax benefits

Based on many variables such as purchase price, down payments etc., the first property may yield you around $300 per month cash flow. Nothing to write home to mama about.

$300 times 12 months is only $3,600 in cash flow. Wow why bother?

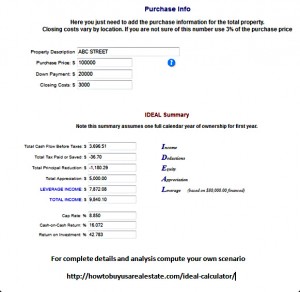

Consider however, the property (let’s assume it’s a $100,000 property) also has a 5% appreciation per year (the national average is 6% over the past 50 years). This 5% growth represents another $5,000 in appreciation which will gain again year after year). Now you have $8,600 gained per year. Then there are tax benefits. This will vary by individual circumstances and many variables around that. See a great case study here.

With this extra cash flow of $3,600 per year you now have to pay taxes on, you can offset that extra cash flow and typically erase it on paper with deductions, Yes, cash in pocket but losses on paper is a great thing. So for this example we will call that a wash.

Then you have your tenants paying down your mortgage payment for you each year. This mortgage reduction adds more net worth to your portfolio. This can average another $100 per month in value (varies by person based on interest rates and loan amount). So $100 x12 month is another $1,200 per year, bringing your total benefit to $14,700.

Lets recap:

3,600 cash flow

$5,000 appreciation

$0 tax benefit

$1,200 principle deduction

$9,800 total benefit

Lets recap:

3,600 cash flow

$5,000 appreciation

$0 tax benefit

$1,200 principle deduction

$9,800 total benefit

So to answer the question of how many properties do you need to have a lucrative investment?

Based on this example of a $100K property, the returns run close to $10,000 per year (note: each year the returns tend to increase as most expenses are fixed, the rents increase and the loan amount decreases)

You simply need to do the math. Take the amount you consider to be lucrative. Lets call it $100,000 per year divided by $10,000 per property and you will want to have 10 real estate investment properties.

Insert picture here

You probably already notice that for every $100K in investments, it will generate close to 10% return. Rough numbers suggest you can buy 10/$100K properties or perhaps 1/million dollar property for the same $100,000K return.

Need some help with your numbers? Check out our free tool: IDEAL Investing Real Estate Calculator

The secret to building a lucrative investment portfolio

First you simply want to get past the hurdle of the first investment. The first investment (just like the first of anything) is the toughest thing I see new investors struggling with. I will bet I see the average investor spend two years looking, researching and trying to get ready to make their first investment.

Once they do, they are off to the races. Some hit a home run right away while others may use the first one as a learning process and then tweak the process and their mindset of the investments and what their true expectations should be and then their next purchase is sound.

It all starts with making the first investment, embracing the returns and process and duplicating until you reach your required outcome. Once you know how much you want to make, simply do the math.

In the above exercise you can see 10 properties will generate as much as $100k a year combined, cash flows, tax savings, equity growth and appreciations. 10 properties may generate $100K, 20 properties may generate $200k and so on.

Most people, after buying their first couple, will refinance their first purchase to take cash out to create a down payment for a future purchase. Getting the first 1 purchased is paramount, the second and third will more easily follow and then YOU are off to the races.

If you have been thinking about investing for a LONG time, stop thinking and start doing. Give me a call today to get started 941-718-7761.